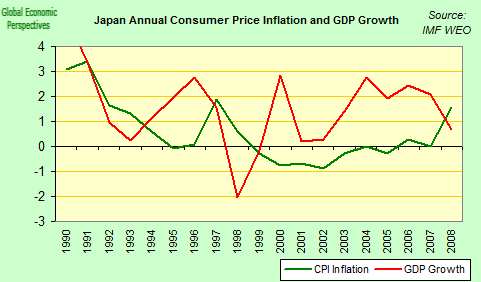

The evolution of inflation, π(t), and unemployment, UE(t), in Japan has been modeled. Both variables were represented as linear functions of the change rate of labor force, dLF/LF. These models provide an accurate description of disinflation in the 1990s and a deflationary period in the 2000s.

In Japan, there exists a statistically reliable (R^2=0.68) Phillips curve, which is characterized by a negative relation between inflation and unemployment and their synchronous evolution: UE(t) = -0.94π(t) + 0.045. Effectively, growing unemployment has resulted in decreasing inflation since 1982.

A linear and lagged generalized relationship between inflation, unemployment and labor force has been also obtained for Japan: π(t) = 2.8*dLF(t)/LF(t) + 0.9*UE(t) - 0.0392. Labor force projections allow a prediction of inflation and unemployment in Japan: CPI inflation will be negative (between -0.5% and -1% per year) during the next 40 years. Unemployment will increase from ~4.0% in 2010 to 5.3% in 2050.

The figure below shows a scatter plot for unemployment (NAC) and CPI inflation in Japan. A linear regression gives a negative slope of -0.94 and constant tern 0.041 for the period between 1982 and 2006. This regression has been calculated with various time shifts between the unemployment and inflation time series. The best fit (R^2=0.68) was obtained in the case wen the unemployment curve and the inflation curve are not shifted. Before 1982, there is no linear relation between unemployment and inflation where the CPI inflation curve is modified according to the results of the linear regression.

Inflation/unemployment scatter plot and linear regression for the period between 1982

and 2006. Neighboring years are connected by a curve. This curve represents the Phillips curve for Japan. R2=0.68. Regression coefficients are -0.94 and 0.041. Therefore, increasing inflationleads to decreasing unemployment and vice versa. Similar link between inflation and

unemployment is observed in Germany.