The inflation rate in Japan was recorded at -0.10 percent in December of 2012. Historically, from 1958 until 2012, Japan Inflation Rate averaged 3.04 Percent reaching an all time high of 25 Percent in February of 1974 and a record low of -2.52 Percent in October of 2009. In Japan, the most important categories in the consumer price index are Food (25 percent of total weight) and Housing (21 percent). Transportation and communications accounts for 14 percent; Culture and recreation for 11.5 percent; Fuel, light and water charges for 7 percent; Medical care for 4.3 percent; Clothes and footwear for 4 percent. Furniture and household utensils, Education and Miscellaneous goods and services account for the remaining.

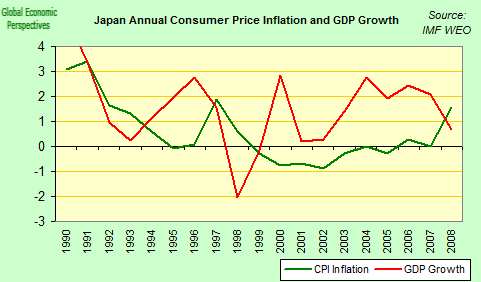

According to the chart below, Japan's inflation rate as measured by the consumer price index was generally meandering around the zero percent level.

In 1990 a stock market bubble burst in Japan. Two years later an even larger real estate bubble burst. The economy was hit by a recession. Huge monetary and fiscal stimuli were implemented, and government indebtedness went through the roof, rising from 60 percent of GDP to as high as 200 percent, where it stands now.

Despite all the money printing and government stimulus going on in Japan for many years, there hasn’t been inflation until now, that is. In general, there are two reasons for Japanese price stability. First, a very high savings rate combined with strong patriotism enabled Japan to internally finance the steeply rising government indebtedness. And, second, domestic private and institutional investors bought nearly all government debt issued during these past 15 years. Hence Japan did not have to compete internationally to raise capital, thus interest rates not only stayed low but fell ever lower.

In 2013, Japan signals a new strategy to boost economy with a 2% inflation target. The goal is to shake the world’s third-largest economy from two of its most unrelenting problems, chronic deflation and a strong currency, which hurts Japan’s exporters by making their products more expensive overseas. But the strategy represents a particular gamble for a nation already with the highest debt burden in the developed world, at 220 percent of the gross domestic product.

没有评论:

发表评论